capital gains tax increase news

Bidens tax increases say Americas richest citizens can afford to pay more. Yet for those with capital gains in.

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

By Naomi Jagoda - 072421 500 PM ET.

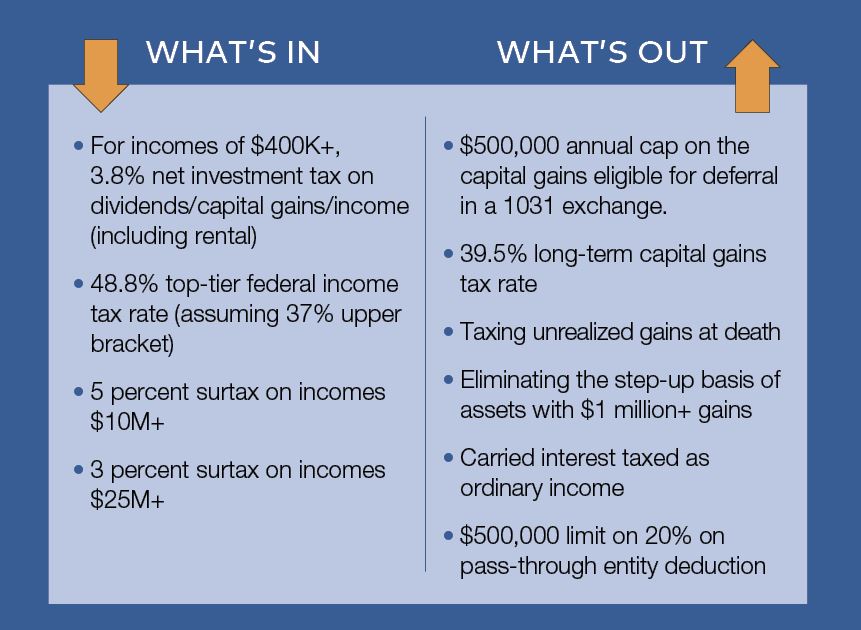

. If the asset is jointly owned with another person its possible to use both. To summarize many of the OTS proposals did not pass however we can see there are some increases in tax for capital gains. September 15 2021 455 PM MoneyWatch.

The Capital Gains Tax rates and allowances for 2022 are. Rumours are circulating that Hunt is looking at tinkering with Capital Gains Tax including the possibility of changing the reliefs and allowances on the tax or increasing the tax. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

President Biden will propose a capital gains tax increase for households making more than 1 million per year. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital. Capital Gains Tax News.

The mooted proposal is. While 100000 is real money it will be paid by a group of people who earn an. The same as for 2021 to 2022 - 12300.

Since capital gains tax commenced on 20 September 1985 all assets acquired are subject to CGT unless specifically excluded such as a main residence. Biden may call for increasing the top capital gains tax to 396 percent plus the surtax sources told NBC News. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one.

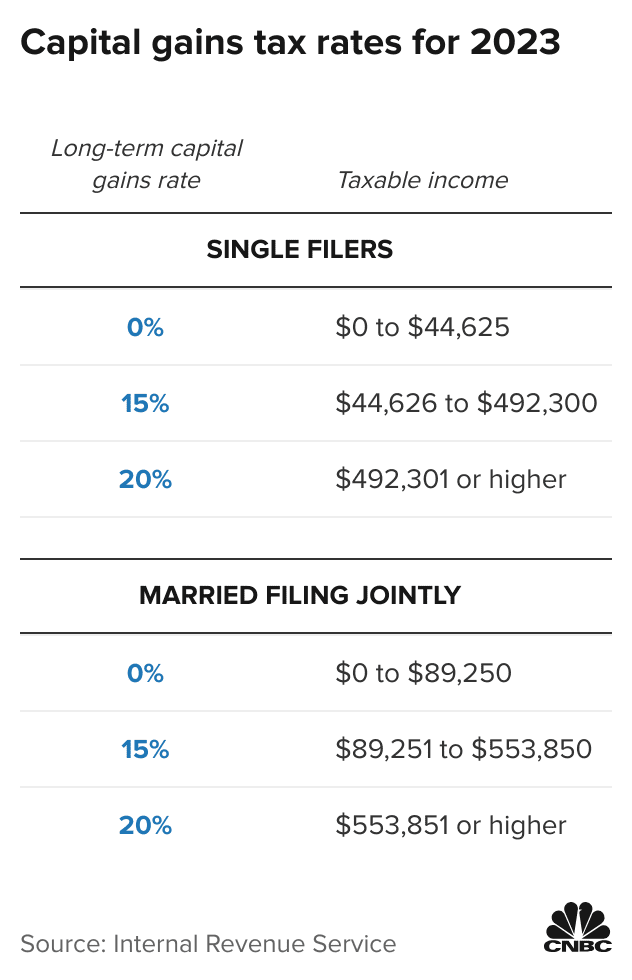

According to the UK Government CGT is a tax on the profit when you sell or dispose of something an asset thats increased in value. That threshold will rise about 7 to 44625 in. Proponents of the increase say bringing taxes on investment.

The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35. The Wharton researchers concluded that tax avoidance much of it legal would cut nearly 900 billion of what the proposed increase on capital gains taxes could raise for the. Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility.

For instance in 2022 single taxpayers who earn below 41675 arent required to pay capital gains taxes on their investments. Capital gains from tangible assets such as fine art antiques coins and valuable wine are typically taxed at a maximum 28 tax rate regardless of how long the investor holds. Its the gain you make thats.

Without tax free capital gains for. The top rate would jump to 396 from 20. Capital Gains Tax is expected to raise 15 billion this tax year which is approximately 15 of the Treasurys total intake according to the report by The Office for.

Mr Hunt is looking at raising the dividend tax rate and a cut to the tax-free dividend allowance in a 1bn-a-year tax raid on pensioners business owners and the self. Proponents of Mr. The Treasury is mulling increases to Capital Gains Tax and Dividend Tax as he seeks to make fair changes to fill a 50billion gap in the UKs finances.

But because the higher tax rate as.

Big News For Stock Market Investors Preparation To Replace Capital Gains Tax Tax Burden May Increase

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

The Impact Of President Trump S Proposed Tax Reforms On Your Bottom Line Glaser Weil Fink Howard Avchen Shapiro Llp

As U S Capital Gains Tax Hike Looms Wealthy Look For Ways To Soften The Blow Reuters

Biden Focuses On Capital Gains Taxes As He Seeks Money For Social Programs Wsj

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

You Don T Rebuild A Healthy Economy By Punishing Those Who Invest Ways And Means Republicans

Awb On Twitter Voters Overwhelmingly Give Thumbs Down To Capital Gains Tax Awb News Https T Co Mwxcpntrl8 Waleg Waelex Https T Co Bxefaf5uea Twitter

What You Need To Know About Capital Gains Tax

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Joe Biden S Proposal To Double Capital Gains Tax Rate Shakes Financial Markets Economics Bitcoin News

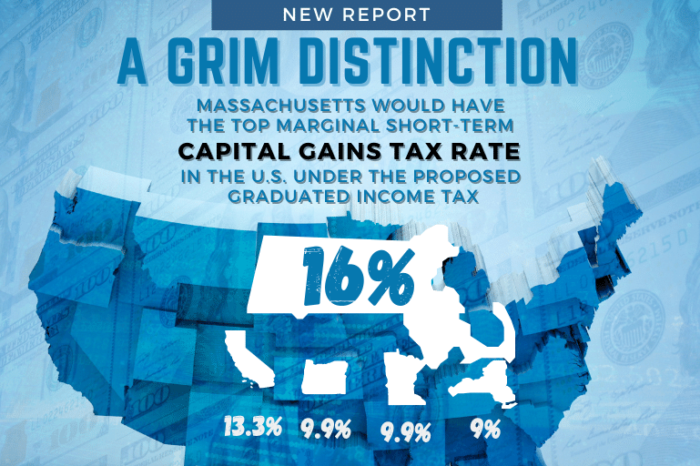

Study Warns Massachusetts Tax Proposal Would Deter Investment Stifling The Innovation Economy Covid Economy Latest News

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Biden S Capital Gains Tax Increase Is More Unproductive Misdirection The Hill